As the cost of living keeps on rising, every person is looking for ways to save some cash. This is especially true when the holiday season comes as we all tend to overspend before Christmas.

If you are feeling stressed thinking about the upcoming holidays and want to minimize your spending during this festive season, here are the best tips on how to save on Christmas gifts and have enough cash to fund everything.

When You Should Start Saving

This is a common question for thousands of consumers who wait until the last minute to go holiday shopping. The earlier you start thinking about next Christmas the better for your wallet.

When people don’t save anything during the whole year they will definitely feel stressed and frustrated having to borrow money instantly or use their credit cards in order to finance their holiday needs and purchase presents for family and friends.

There is no reason to experience this stress if you can think about your needs beforehand and plan ahead. Why don’t you save a small portion of your income each month? Put some cash aside on a monthly basis and you will be wealthy by December.

This way, you will feel more secure and confident while having enough funds to cover all the presents and gifts for your loved ones without getting into debt.

Top Ways to Save Cash for Christmas

Here is a list of the best advice on how to save your money and have more cash for the upcoming holiday season. Choose one or several tips and follow them to avoid stress and have peace of mind:

#1 Be Creative

Do you have great skills in sewing, baking, or painting? Are you a creative person who likes making something with your own hands? Why don’t you take advantage of that and create your own gift for Christmas that may be given to your friends and relatives?

It can become a really cheap present for you and you may showcase your creative abilities. You may knit a holiday scarf, bake some cookies, or create a framed photo to give it to your loved ones.

#2 Use Special Offers

Another great way to save some money is to utilize special offers from various shops before the holiday season comes. Again, if you start putting some cash aside each month for the next Christmas you may use these funds to purchase items on special offers far in advance.

You may need some food or drinks that can be bought ahead of time and just wait till you open them. Also, you may look for book vouchers and other special offers to minimize your spending.

#3 Get Rid of Cable

Have you been thinking that you pay too much for cable? Why don’t you stop wasting your cash each month on that? You really don’t need to have cable in the 21st century since there are so many alternatives including Netflix, Amazon Prime, Apple TV, Hulu, etc. ‘

According to the statistics, among Americans who do not have subscriptions to cable or satellite TV, 61% say that they had it in the past, while 39% say they have never been subscribers.

If you cut out your cable you will be able to save about $200 each month which may add quite a large sum over the period of several months until the next year. This is the cash you may invest in holiday shopping.

#4 Take Your Own Lunch with You

You may be surprised to know that you spend about $150 on lunches at the drive-thru or takeaways each month. How much can you save if you take your own lunches with you for 6 months?

Average annual food away of Americans (in U.S. dollars)

This is incredible but you may really stop wasting that cash while choosing a cheaper alternative and taking leftovers from home while having more cash for the Christmas gifts.

This is incredible but you may really stop wasting that cash while choosing a cheaper alternative and taking leftovers from home while having more cash for the Christmas gifts.

#5 Sell Old Items

This option is useful for people who have a lot of old stuff they don’t need anymore. You may get rid of it by selling your old items and getting some quick cash. You won’t save a lot of course but you will have a bit more to spend during the festive season.

It’s much easier to sell your old items today. You don’t even have to organize a garage sale as everything may be sold online. Take a picture of your things and post them on the web or in a special app. Wait for people to contact you and sell everything you don’t need now. You may utilize Decluttr, OfferUp, LetGo, Poshmark, and other apps.

#6 Use More Cold Water

If you wash your dishes with warm or hot water you may be surprised to hear that cold water may also make them equally clean. If you wash the dishes in cold water you will also be able to lower your utility bills and save more for Christmas. Simply change the temperature settings to cooler water and save up to $50 a month. Don’t forget to turn off the faucet when you brush your teeth as well.

#7 Pause Your Subscriptions

Think about the number of subscriptions we all have in our lives. You may pay for Audible or meal kit delivery service each month. Such costs may add up and turn into several hundred dollars that you can save up for Christmas gifts and avoid getting into debt.

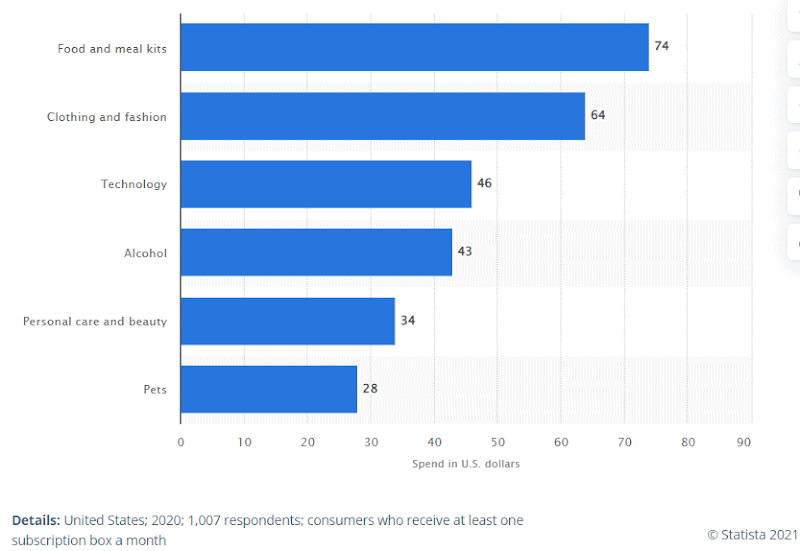

Monthly subscription box expenditure among subscribers in the United States in 2020

Some subscriptions may be cheaper than others but they all add up. Pause your gym membership as well. Do you really visit the gym? Many people forget about their membership, especially during the holiday season.

So, instead of paying your cash and not visiting you may save this money for other needs. Pause your membership for a month and have an additional $100 for the upcoming Christmas.

In conclusion, you should stop thinking that the festive season is still far away and you will have enough time to prepare for it. Start saving for Christmas as soon as possible to have enough money before the next holiday. Use budgeting apps to keep track of your finances and set aside enough to have a merry Christmas.