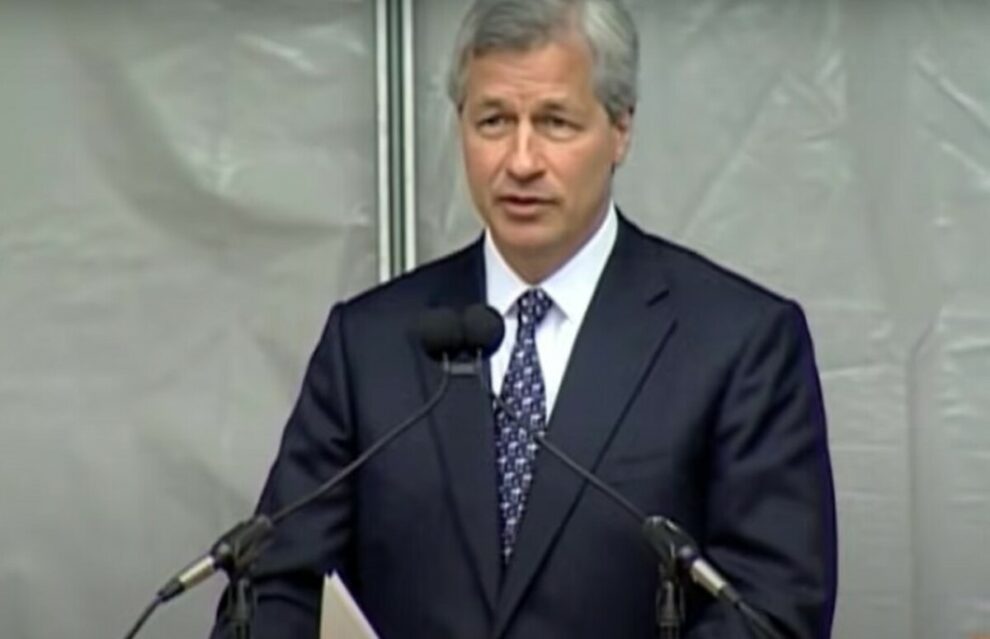

Jamie Dimon, CEO of JPMorgan, has proposed that governments should seize private land to construct wind and solar farms.

Dimon, who donates to the Democratic Party, believes that urgent action is necessary to fast-track green energy initiatives. He claims the time is running out to prevent the most damaging consequences of climate change, Telegraph reported.

JPMorgan CEO suggests governments should seize private land for wind and solar farms

Dimon shared in his annual shareholder letter: “Permitting reforms are desperately needed to allow investment to be done in any kind of timely way.

“We may even need to evoke eminent domain. We simply are not getting the adequate investments fast enough for grid, solar, wind and pipeline initiatives.”

The suggestion made by Dimon is a rare proposal coming from a prominent Wall Street banker.

Some US states are restricting the use of the eminent domain. It is the legal process by which state authorities can force private property owners to sell their assets for public use, with compensation provided.

The suggestion by the CEO may stir controversy, especially coming from a Wall Street bank CEO.

Additionally, Dimon also commented that the conflict in Ukraine is prompting nations and corporations to reconsider their approach to energy security planning.

Dimon urges prompt action to provide affordable and reliable energy

The CEO added that affordable and reliable energy is needed both now and in the future. Furthermore, investments are required to reduce carbon emissions. And these actions are linked to economic growth, energy security, and climate change.

“To expedite progress, governments, businesses and non-governmental organisations need to align across a series of practical policy changes that comprehensively address fundamental issues that are holding us back,” he added.

“Massive global investment in clean energy technologies must be done and must continue to grow year-over-year.”

Insurers and pension funds in the UK had expressed their dissatisfaction with the EU-era regulations under the Solvency 2 rules. This has limited their capacity to invest in infrastructure, including renewable energy projects.

However, recent reforms to Solvency 2 rules are predicted to stimulate an increase in investment in renewable energy projects in the UK.