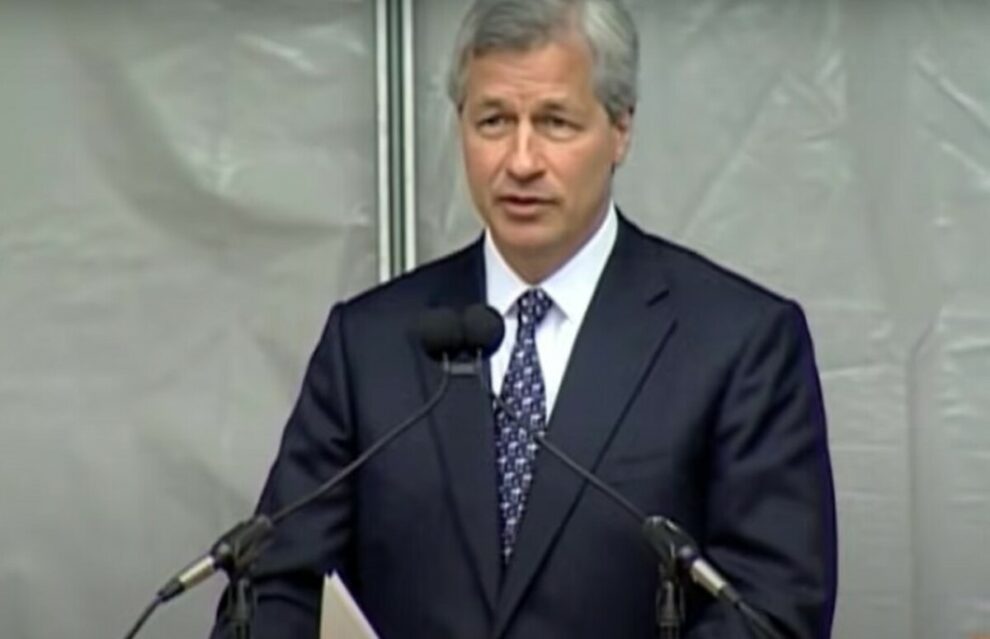

In his annual letter to investors, Jamie Dimon, the CEO of JP Morgan Chase, said that the world had been “generally on a path to becoming stronger and safer” in recent years, but experienced a significant setback in February 2022 with Russia’s invasion of Ukraine, The Guardian reported.

“When terrible events happen, we tend to overestimate the effect they will have on the global economy,” Dimon said. “Recent events, however, may very well be creating risks that could eclipse anything since world war II – we should not take them lightly.”

JP Morgan boss Jamie Dimon urges unity amidst global challenges, calls for collaborative efforts in letter

Jamie Dimon’s annual letter to JPMorgan Chase shareholders provides insights not only into his perspectives on business but also on the economy, describing the current period as a “pivotal moment for America and the free world.” Dimon addresses deep divisions within the country and the uncertainty prevailing on a global scale.

The CEO of Wall Street banking didn’t specifically reference the conflict between Israel and Gaza in recent months. However, he acknowledged the “abhorrent attack on Israel and ongoing violence in the Middle East.” In his letter, he highlighted that these events have disrupted numerous assumptions about future safety and security, leading us to a “pivotal time in history,” NY Times reported.

He added in his letter to JP Morgan’s shareholders: “The ongoing wars in Ukraine and the Middle East could become far worse and spread in unpredictable ways. Most important, the spectre of nuclear weapons – probably still the greatest threat to mankind – hovers as the ultimate decider, which should strike deep fear in all our hearts.”

“America’s global leadership role is being challenged outside by other nations and inside by our polarized electorate,” Dimon said. “We need to find ways to put aside our differences and work in partnership with other Western nations in the name of democracy. During this time of great crises, uniting to protect our essential freedoms, including free enterprise, is paramount.”

Navigating economic challenges and embracing technological advances

While the economy shows resilience, there’s a red flag concerning the government support it relies on, the letter stated. Consumers are spending, and investors anticipate a smooth transition. However, the CEO said that the economy’s momentum is fueled by government spending and increasing deficits.

“The deficits today are even larger and occurring in boom times — not as the result of a recession — and they have been supported by quantitative easing, which was never done before the great financial crisis,” he writes.

Inflation might prove stubborn, he says in his letter to JP Morgan shareholders. Dimon notes that the markets appear to be anticipating a 70% to 80% likelihood of a soft landing, characterized by moderate growth alongside decreasing inflation and interest rates. However, Dimon suggests that the actual probability of this scenario is much lower.

Dimon, like other CEOs, expressed optimism regarding the potential of AI, CBS News reported. He said that the bank has identified 400 applications for AI thus far, especially within its marketing, fraud detection, and risk management divisions. Additionally, the bank is considering AI’s implementation in software development and enhancing overall employee productivity.