I’m sure you’ll agree with me that COVID-19 crisis has affected most businesses across the world, especially the small and medium scale enterprises (SMEs). With one in four small businesses in the US on the verge of shutting down, we can only hope for something good to happen. However, according to the US Small Business Administration (SBA), they are willing to give out loans, including PPP and three others, to save businesses. To be eligible, all you need is to fill out the PPP application form, and you can receive the loan.

What Is The PPP Program All About?

The Paycheck Protection Program (PPP) is an SBA loan intended to help business owners keep their staff on payroll amid COVID-19 pandemic. No doubt, loans are meant to help people with the intention that they’ll pay back later. However, SBA is willing to forgive loans if employers will put their employees on payroll for eight weeks and others for mortgage interest or utilities. The loan program has started since April 3 and will be available through June 30, 2020.

Is The PPP Application Form Difficult To Fill Out?

Well, it turns out that filling out the PPP application form may not be as difficult as you thought. All you have to do is follow some simple steps, and you’ll be eligible to receive the loan.

In this article, I’ll be showing you exactly how you can fill out the PPP application form without having to go through stress.

So, if you want to know more, all you have to do is read on.

How To Fill Out PPP Application Form

While it’s easy to fill out PPP application form, it’s also essential that you understand that time is a factor for receiving the loan. Since the loan is ending by the end of June, you might want to hasten up, and fill the form before it becomes too late for submission.

So, let’s have a look at the steps involved in filling the application form below:

Step 1: Access Your PPP Application

As soon as you request to receive the loan through the SBA website, you’ll get redirected to your PPP application. There, you can get to edit your application or fill out each section of the form.

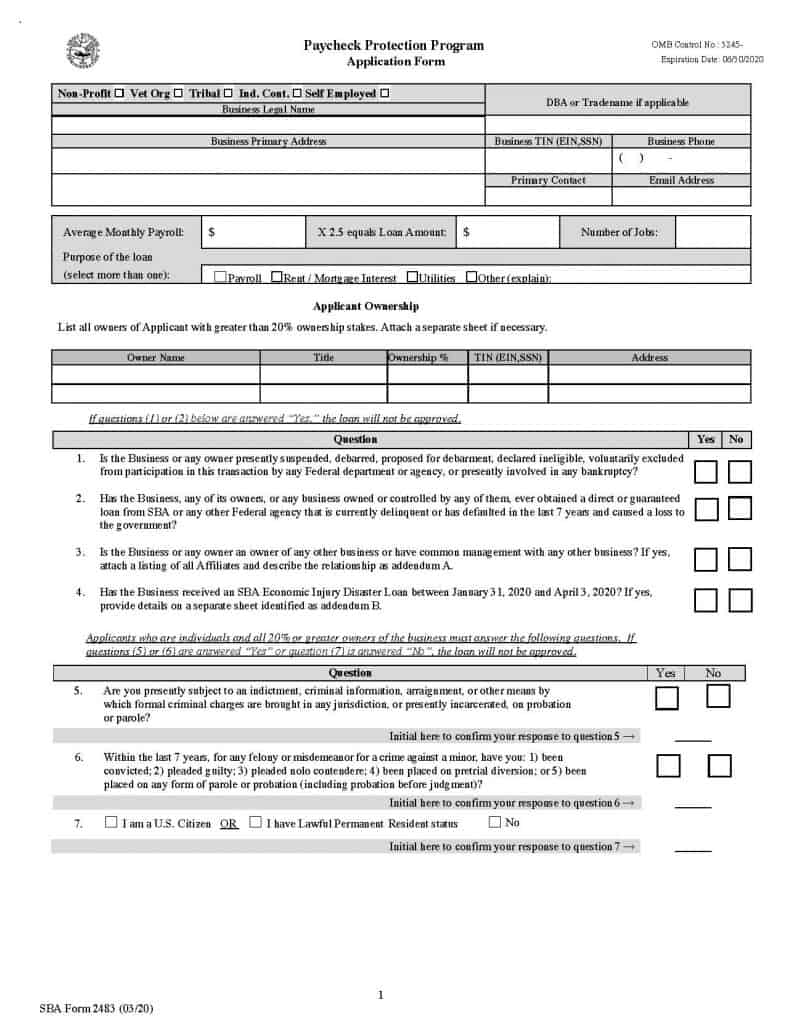

Step 2: Add Your Existing Business Information

Adding your existing business information involves filling out some sections, including:

- Your Business address and including the 5-digit zip code.

- Business type, and selecting the right one to prevent future delays in receiving the loan.

- Enter your 9-digit business tax ID number and ensure you fill it correctly.

- Also, add your desired loan amount. However, you might need to calculate, as it shouldn’t exceed 2.5 times your average payroll costs.

Lastly, you’ll also be required to verify your employee count.

Step 3: Add New Requirements For Your Business Information

In this section, you need to add your business start date, which should be the same as the one on your secretary of state filling. Besides that, you’ll also need to type your business industry and select from the ones that appear on the menu options.

Step 4: Enter Ownership

This requires you to confirm the ownership percentage of the applicant. Of course, this must be greater than zero for you to be eligible for the loan.

Step 5: Enter Additional Information About You

This requires adding all essential information for the additional owners – that’s if you have any of them with 20% share and above. Also, ensure you fill out all the information, including the date of birth of the other owners. Besides that, you’ll also need a color copy of the owner’s Driver’s License (front and back).

Step 6: Upload Your Documents

To be eligible for the loan, you must upload the Driver’s License for all owners and the Acceptable Payroll Documents.

For Businesses, the acceptable payroll documents include:

- 941 Quarterly Tax Filings (2019, 2020 Q1)

- 944 Annual Tax Filings (2019)

- Payroll Register for the previous 12 months

- 12 months most recent bank statements

For 1099 Independent Contractors or self-employed individuals applying for a PPP loan, your acceptable payroll documents include:

- IRS 1040 Schedule C

- 1099s (under which you were paid)

- Income and expense reports for 2019

For all applicants, they include:

- Business account bank statements

- Any other document that can prove your payroll expenses

By following the above steps, you’ll get to fill out your PPP application form seamlessly. However, ensure you submit the form on time, to stand a higher chance of getting the loan.