The automotive industry and investment world are currently witnessing significant shifts. Tesla (NASDAQ:TSLA) a pioneering force in the electric car boom and one of the most talked-about companies of the last decade, is facing substantial financial challenges that have led to a considerable decrease in its market value. The events are resonating in business circles as Tesla slips out of the ten most valuable companies in the S&P 500 index (SP:SPX).

Under the dynamic leadership of its charismatic founder and CEO, Elon Musk, Tesla has disrupted the market with its innovative approach to electric vehicles manufacturing and an appealing corporate culture. The success of Tesla partly determines the prospects of the entire electric transport sector. However, various factors have contributed to Tesla’s decline in market value.

Elon Musk’s sale of a significant portion of Tesla shares has exerted pressure on their value.Moreover, the ongoing shortage of semiconductors and other crucial components poses challenges to Tesla’s production and delivery capabilities. Additionally, disappointing financial reports and forecasts have fueled concerns among investors about the company’s future earnings for several consecutive quarters. The broader economic uncertainty, including factors like inflation, Federal Reserve interest rate cuts, and international tensions, has also dampened investor confidence in technology stocks.

One of the primary challenges Tesla faces is the intensifying competition from other automakers, both traditional and emerging brands, who are aggressively expanding their electric vehicle offerings. This heightened competition has been testing Tesla’s market standing, leading to its recent displacement as the world’s largest electric car manufacturer by China’s BYD and its drop from the top ten most valuable companies in the S&P 500 index. Currently, Tesla’s market capitalization stands at $558 billion, making it appear less expensive than Broadcom Inc. (NASDAQ:AVGO) with $606 billion.

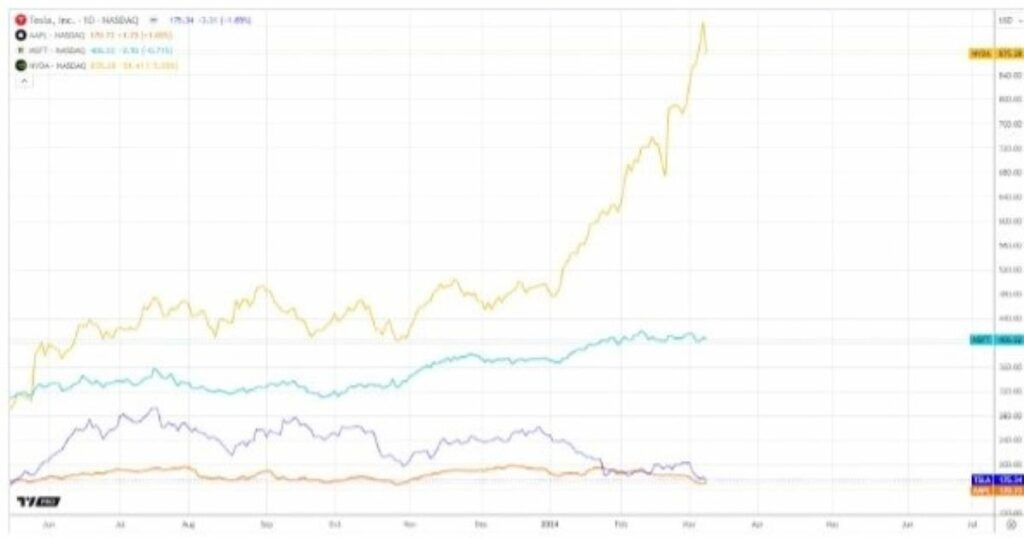

Furthermore, this decline in Tesla’s value has significantly impacted its position among the most valuable companies. Despite remaining the largest electric vehicle manufacturer globally, Tesla’s market capitalization during its decline lagged behind companies like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and NVIDIA (NASDAQ:NVDA), which continue to dominate the S&P 500 list.

Last year, Tesla’s operating profit margin decreased from 17% to 9%, and this year, the company faces even greater risks. The decline in Tesla's stock price and market value serves as a crucial indicator for investors and analysts, offering insights not only into the company’s performance but also broader trends within the electric car market and technology stocks.

The critical question arising from this situation is whether these difficulties are temporary hurdles or signs of significant structural shifts in the industry. The future of Tesla hinges on its ability to adapt to evolving market conditions. Elon Musk and his team must focus on restoring the brand’s prominence, enhancing production capabilities, and reinforcing investor confidence. Assessing Tesla’s position and its potential impact on the industry underscores the dynamic and uncertain nature of the current landscape.