Meta Platforms’ strategic turn towards artificial intelligence and smart glasses is accompanied not only by a reduction in investments in virtual reality, but also by an increase in financial and legal risks, which are beginning to create a new area of uncertainty for the company’s business.

The recent 10% staff reduction at Reality Labs was part of a larger Meta effort to align costs with the actual pace of commercial adoption of VR technologies. Since the end of 2020, this area has led to the company’s cumulative losses exceeding $70 billion, and, as Meta Chief Technology Officer Andrew Bosworth acknowledged, the market growth rate has been significantly lower than initial expectations. As a result, the company closed several VR studios, curtailed development of individual game projects, and abandoned corporate products, focusing resources on mobile versions of the metaverse and smart glasses, which offer higher returns on investment.

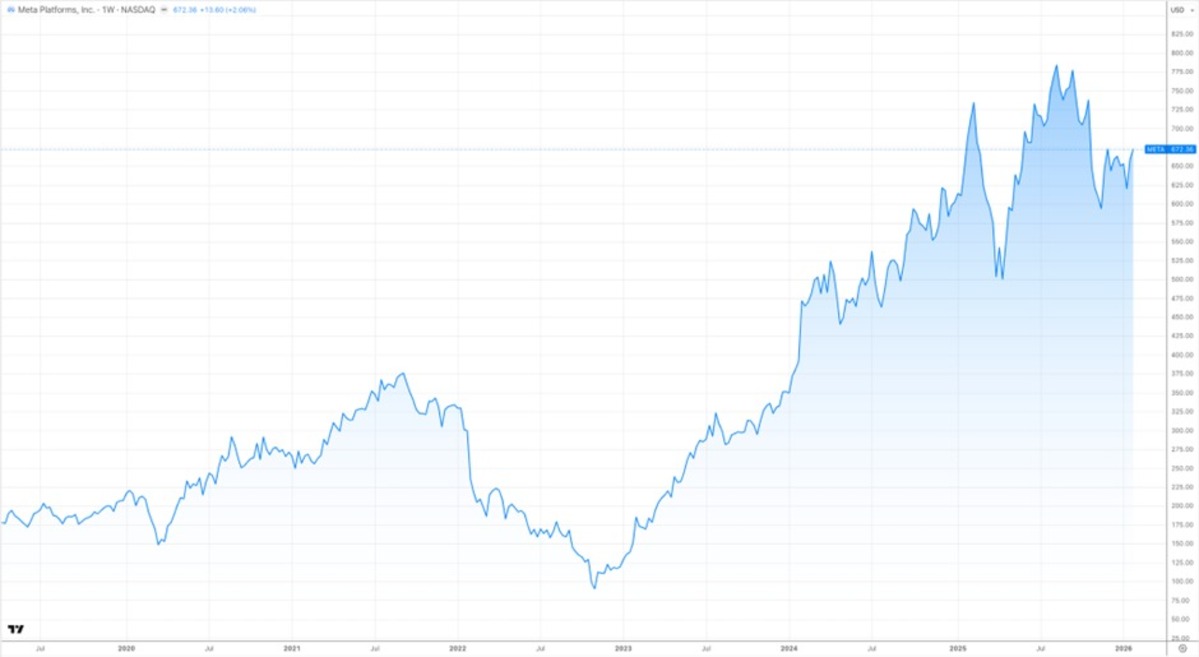

Against this backdrop, American stock indices, particularly the Dow Jones Industrial Average, which includes Meta as one of its largest technology constituents, also came under pressure. The market perceives the cost reduction at Reality Labs as a step toward improving operational discipline; however, the growth of legal risks and uncertainty surrounding the long-term monetization of new products increases share price volatility. As a result, the technology sector’s contribution to the Dow Jones’ dynamics is becoming less predictable, and the index itself is increasingly responding not so much to macro statistics as to corporate news and potential financial liabilities of large issuers.

Market statistics also confirm the financial logic of such a reversal. According to IDC, shipments of classic VR devices decreased by almost 43% last year, while the segment of smart glasses increased by more than 40% and may grow by more than 200% this year. It is this market that Meta considers as a scalable source of revenue, especially in the context of the partnership with EssilorLuxottica and the high demand for the Ray-Ban Meta line, for which the companies are even discussing expanding production capacity.

However, amid sales growth, pressure from legal risks is rising. Solos Technology has filed a lawsuit against Meta, EssilorLuxottica, and Oakley, accusing them of willful patent infringement covering key smart glasses technologies. The plaintiff is seeking compensation in the amount of several billion dollars and an injunction against the distribution of the disputed devices. Even if sales do not come to a halt, the potential costs, including compensation, royalties, or a protracted lawsuit, can significantly affect the financial model of the area, which Meta considers one of the key sources for future growth.

A class action lawsuit filed in the United States by an international group of WhatsApp users is also putting additional pressure on the company. The plaintiffs accuse Meta of misleading users about the confidentiality of correspondence and claim that the company stores and analyzes messages it allegedly encrypts. Although Meta categorically denies these accusations and calls the lawsuit unfounded, the proceedings themselves pose the risk not only of fines and legal costs but also of reputational damage to one of the company’s largest assets, the monetization of which is directly tied to user trust. Elon Musk also contributed to the dispute, claiming that Meta indeed does not provide the required safety and proposed switching to X chat, which he sees as the most secure solution. However, users may disagree with this statement, with some believing that X chat encryption is not safer and that their messages can be accessed by X’s employees. For X, in the event of a possible lawsuit, the consequences would also be significant and may even affect other Musk businesses and Tesla stock price in particular.

Together, these factors form a challenging financial backdrop for Meta. On the one hand, the company is reducing unprofitable areas and redistributing capital to more promising segments. On the other hand, it is facing growing legal and regulatory threats precisely where it expects to generate new profit. For investors, this means that Meta’s future revenue and profitability will increasingly depend not only on technological advances but also on the outcomes of legal disputes that can affect both its cost structure and its long-term strategy.

Add Comment