Nvidia is in the spotlight again, this time together with OpenAI, with which it has agreed to a partnership. The deal looks very promising, as the graphics accelerator manufacturer is investing about $100 billion in the development of large language models. The funds will be used for the construction of data processing centers with a total capacity of 10 GW. Such a scale is difficult to comprehend, but to put it in perspective, it is comparable to the energy consumption of entire regions and requires infrastructure comparable in cost to several dozen nuclear reactors.

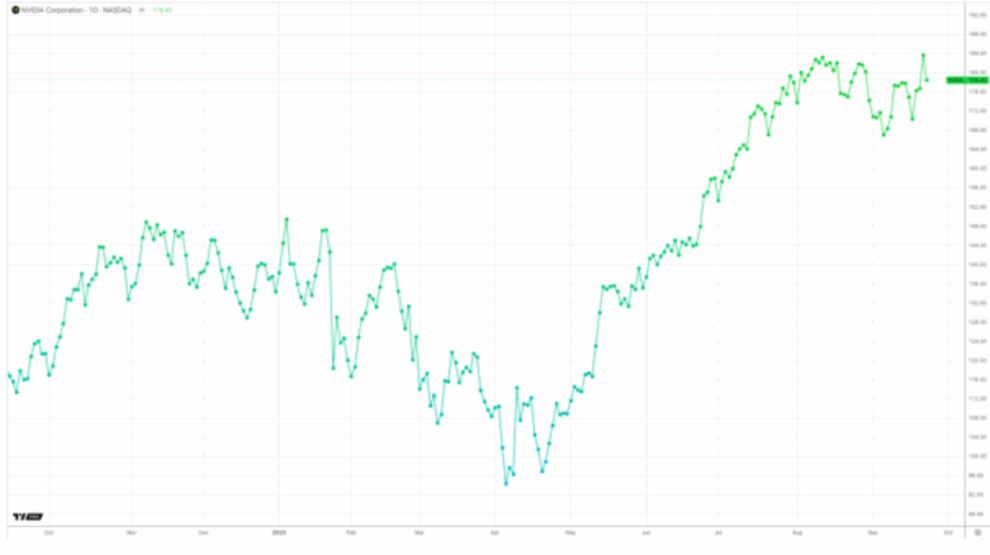

The news immediately impacted Nvidia’s valuation, which at one point exceeded $4.5 trillion, solidifying its position as the world’s most expensive public company. The largest indexes and their derivatives, such as Nasdaq futures, have received a significant boost, as Nvidia’s price growth traditionally pulls up the entire high-tech sector. Additionally, Nvidia’s weight in the S&P 500 exceeds 7%, and any significant movement in its shares can impact the entire trading session.

The Nvidia and OpenAI project is radically changing and reframing the discussion about the future scale of global AI infrastructure. To power a 10 GW data center, more than ten power units of the highest level will be required. To put this in perspective, all Google data centers in 2024 consumed an average of 3.67 GW, which is almost three times less. Already, data centers worldwide consume about 1.5% of global electricity generation, and this share is expected to grow rapidly.

OpenAI previously announced plans to build at least seven data centers with a capacity of 5 GW each. If it succeeds, it will potentially double the energy consumption of the entire state of New York. And, as everyone has long understood, such a scale poses issues of sustainability, diversification of energy sources, and accelerated implementation of nuclear generation for the industry.

Nvidia’s revenue growth over the past year, which has not gone unnoticed, has been accompanied by an increase in its dependence on a rather narrow group of customers. In the last fiscal quarter, 39% of the company’s revenue was provided by only two customers, with the largest accounting for 23%. Nvidia earned a total of $46.7 billion during this period, of which 88% was in the server segment.

It is now becoming clear that investing in OpenAI is only increasing this dependence. Although some of the funds will actually be returned to Nvidia in the form of contracts for the purchase of accelerators, this makes the company both an investor and a key supplier for OpenAI. This concentration creates risks for shareholders, particularly in the event of regulatory changes, the influence of the US government, as well as competitor policies or even potential power outages. For investors seeking stability, such risks often redirect attention toward the US highest dividend stocks, which provide income cushions even during market volatility.

However, the partnership between Nvidia and OpenAI aligns with the overall picture of the technological transformation of the market. Microsoft, Oracle, SoftBank, and other players are already investing in the Stargate megaproject, and Nvidia is becoming its industrial core. At the same time, competition from AMD and cloud providers that are developing their own chips is increasing.

Thus, the Nvidia and OpenAI deal is not only the deal of the century in monetary terms, but also a symbol of a new reality. AI infrastructure continues to evolve into an independent energy and technology sector, the scale of which is comparable to that of traditional industries.

Add Comment